Credit Scores Cards to Conserve Cash

Nowadays, charge cards are not just a tool to pay costs, but they are also ending up being a part of city life. The expanding consumerism is advertising as well as being advertised by the use of charge cards. Every single person, comprising the target customers, is taking into consideration the utmost energy and also the availability of credit cards for the monetary benefits connected.

Nevertheless, a charge card not only uses your expanded possibilities to use your future capital, but it additionally brings with it particular risks and also fears. Utilizing credit cards is a matter of reasonable choice and also an important judgment. If anyhow you make a blunder below, you would certainly be discarded with massive amounts of settlements, then maybe loans, and after that also insolvency. So before you start utilizing your credit card, make sure that you know just how to utilize a bank card to save cash.

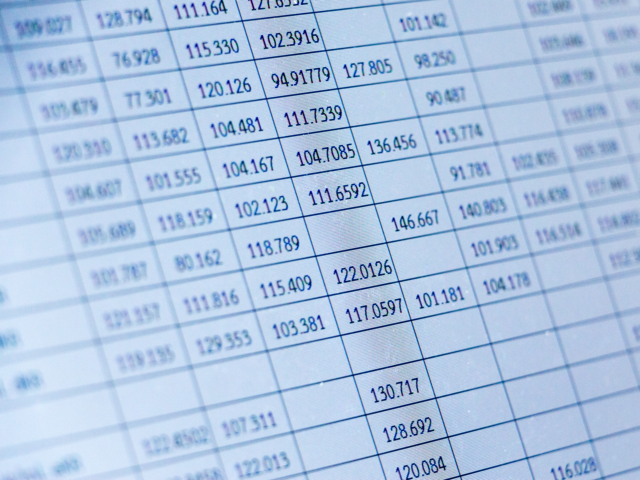

Firstly, be reasonable while choosing a charge card. If you require a charge card, it is constantly much better to contrast the interest rates, centers, and other rewards that different charge cards are providing. Do not forget to check the yearly charges that the providing companies need. It is not a good suggestion to have several bank cards. The risk of identity theft can emerge with the variety of cards you have.

When choosing a charge card, tally the deals of the providing organizations with your requirement and also personal monetary conditions. Go for the one that suits your ideal. Likewise, enquire and also check if the invoicing procedure is based upon the two-cycle setting or single-cycle setting. It is better to choose a single cycle invoicing mode, as it is much easier to get rid of charge card debt soon.

There are a couple of credit cards that supply travel benefits like price cuts on different traveling solutions; selecting such a card can save you a great deal of cash. Insurance policy benefits are such one more deal that can conserve your money on cars and truck crashes, or shedding baggage. Even sometimes they provide refunds on unexpected fatality or dismemberment insurance.

Sometimes, the cards used by Net Expert can save you cash on big purchases, as they pay your ISP membership amount. There are some bank cards that offer bonus offer factors on your every use of the card. At this reward point, you can trade with your acquisitions and also make the purchase free. This is a large assistance for saving money.

As you choose the most ideal as well as cash-saving charge card, currently the technique lies in utilizing it smartly when you read the article in this link.

- It is always wise to restrain from acquiring unbridled. It is better not to purchase anything, which you can not pay in hard cash quickly.

- Do not allow the settlement to run over months. Be careful to settle the sum total in time. Or else a high rate of interest can eliminate a round figure from you.

- If you are not utilizing an interest-bearing account, yet you can make some rate of interest on your spare money by putting the regular monthly spending on your credit card.

- If anyways, after a lot of prevention, you are with a huge settlement stockpile with your charge card, then choose balance transfer with 0% expense as well as interest. It can conserve you a great deal of cash in a risky situation.